Prime Coverage Group, Inc. is a freight factory company:

focused on building strong, long- lasting relationships with customers.

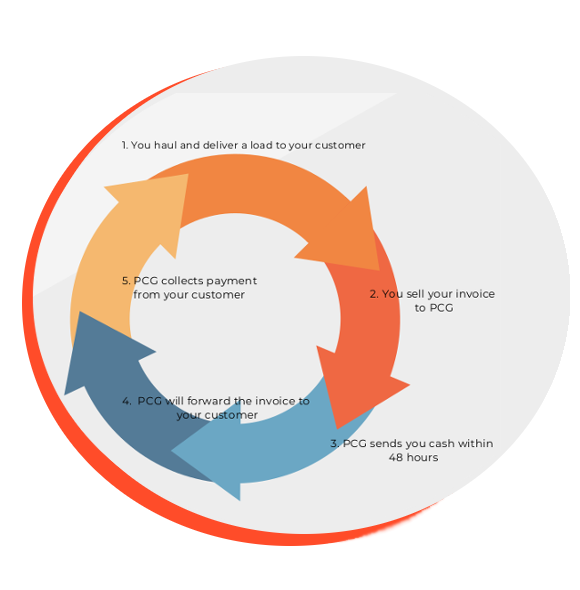

was founded in to help carriers and owner-operators maintain a positive cash flow while growing their business.

has experience working with small, medium, and large companies.

Our Philosophy

Prime Coverage Group, Inc. is passionate about delivering expert advice to our clients, managing their assets, financial affairs, and creating solutions that enable them to reach their financial ambitions in highly competitive markets. We are deeply rooted in the community. Our commitment has been and will continue to be one centered on supporting the financial growth of our customers, operating responsibly as a good corporate citizen, creating a great place to work for our people and working hard to improve our environment.

Our Mission

To be a leading factor in the country, supporting the development of small and middle businesses.

Our Vision

The mission of Prime Coverage Groups is to contribute to the sustainable development companies by providing responsible financial services and solutions to small and medium enterprises, using internationally recognized best factoring practices. We are committed to delivering value for our clients, employees, and society at large. The mission is based on our values: integrity and openness, professionalism and commitment to customers.

Our Goals

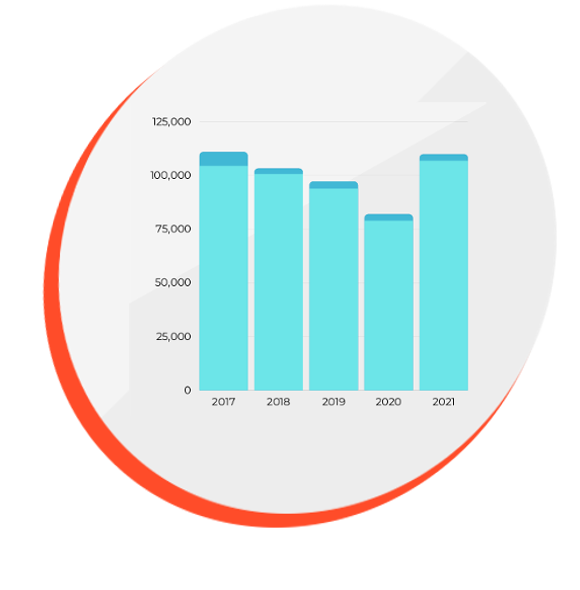

To secure market position as a leading financial service provider for micro and small business customers.